The Recent Increased Scrutiny Of The Cryptocurrency Industry Has Yielded High-Profile Lawsuits Involving Major Cryptocurrency Exchanges, Coinbase And Binance. SEC’s Actions Have Grabbed The Attention Of Investors, Crypto Enthusiasts, And Regulators As All Eyes Turn To Another Prominent Player In The Crypto Exchange Space: Crypto.Com. With Mounting Speculation And Concerns Surrounding Regulatory Clarity, AI Analytics Has Deployed A Powerful Tool In Providing Key Clues And Insights Into The Potential Legal Risks Faced By The Platform. By Leveraging Advanced Machine Learning Algorithms, AI Analytics Offers A Unique Perspective On The Prospects And Legal Vulnerabilities Of Crypto.Com, Giving Stakeholders And Investors Valuable Insights Into The Evolving Crypto Landscape.

What Binance And Coinbase Lawsuit Entails?

The Crypto World Is Being Treated To A Significant Legal Battle That Could Shape Its Future. The SEC Has Launched A Barrage Of Charges Against Two Major Crypto Exchanges, Coinbase And Binance, Raising Crucial Questions About Regulatory Oversight In The Crypto Space. Coinbase And Binance Are Widely Recognized In The Crypto World, Facilitating Billions Of Dollars In Digital Asset Transactions Daily And Serving Global Outreach. However, The Regulatory Framework On Crypto Is Ambiguous As Existing Financial Regulations Were Never Designed With These Digital Assets In The Picture. SEC And CFTC Are Also In Conflict, Claiming Jurisdiction Over Crypto Regulation. SEC Chairman Gary Gensler Argues That Most Cryptocurrencies Should Be Classified As Securities, Enabling His Agency To Enforce Regulations On These Assets And The Platforms Where They Are Traded. Binance Has Discontinued Trading With U.S. Dollars On Its Platform.

Although The Lawsuits Against Coinbase And Binance Differ, In Many Aspects, Both Cases Revolve Around The Allegation That The Exchanges Failed To Register With The SEC, A Requirement For Operating Legally Within The Regulatory Framework. These Legal Battles Will Determine The Fate Of Crypto Exchanges And Establish Which Regulatory Body Holds The Power To Police And Oversee Crypto Projects.

Is Crypto.Com The Next Crypto Exchange On The SEC Whip?

Crypto.Com, A Singapore-Based Cryptocurrency Exchange, Holds Naming Rights To The Crypto.Com Arena, Home To Sports Teams, Including The Los Angeles Lakers, Kings, Clippers, And Sparks. The Company Has Also Secured Sponsorships With Various Other Sports Organizations, Like, UFC And Formula 1.

Amidst The SEC Crackdown, Coinbase And Binance Face Accusations Of Offering Unregistered Securities. In Response, The SEC Has Also Alleged That Binance Mishandled Customer Funds And Misled American Regulators And Investors About Its Operations. In Response To These Regulatory Challenges, Crypto.Com Has Removed Its Institutional Trading Platform In The United States. In Response To The Increasing Regulatory Challenges, Several Cryptocurrency Exchanges Are Considering Moving Operations Overseas To Navigate The Unclear Regulatory Landscape And Mitigate Potential Risks Associated With Continued Operations Within The United States.

Avorak AI: Providing Valuable Analytics

Avorak AI Is A Comprehensive Platform Of Top-Range AI Tools For Businesses And Investors Seeking To Maximize Their Profitability And Efficiency. Among The Platform’s Core Offerings Are The Avorak Trade Bot, Avorak Write, Avorak Create, And Avorak.

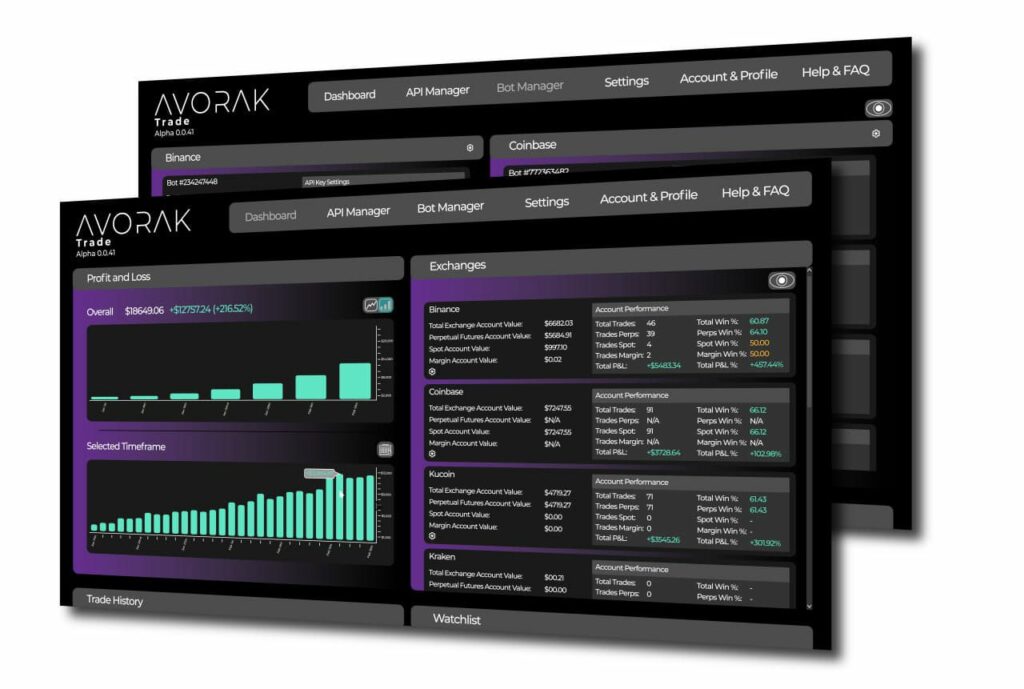

The Avorak Trade Bot Is An Analytics Tool That Utilizes Advanced Machine Learning Algorithms To Conduct Real-Time Market Analysis For Cryptocurrency Traders. It Can Identify Profitable Trades And Minimize Risks, Helping Users Make Informed Trading Decisions. Moreover, The Avorak Trade Bot Is Highly Customizable, Enabling Traders To Set Their Trading Strategies And Other Customized Settings.

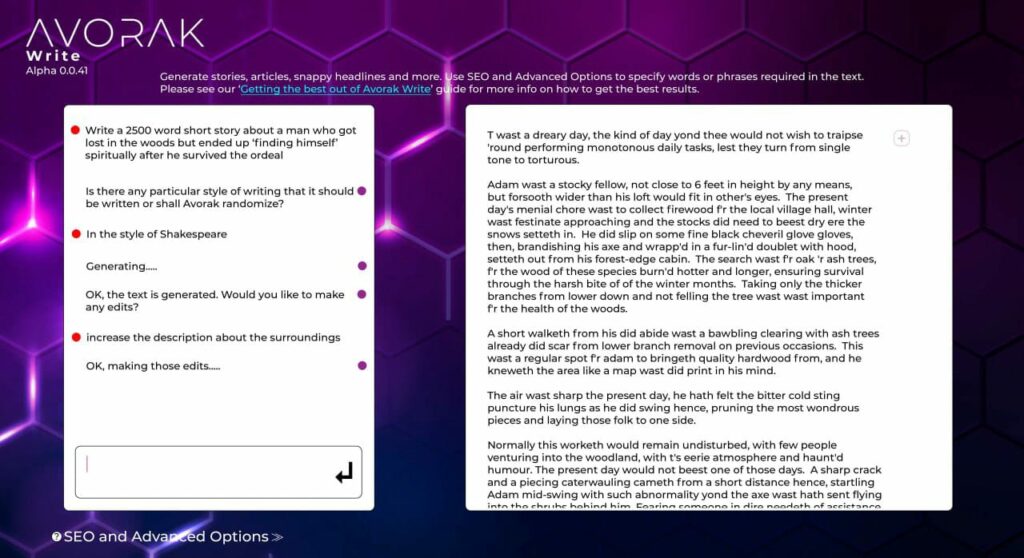

Avorak Write Is A Content-Generation Platform Utilizing Machine Learning To Generate High-Quality And Engaging Online Content. It Provides Custom Content, Including Reports, Summaries, Etc, To Meet Specific Business Needs. Avorak Write Addresses The Issues Of Repetition And Plagiarism Prevalent With Existing Text Generation Tools.

Avorak AI Has A Record ICO In Phase Seven, With One AVRK At $0.255, Having Increased By 325% From The Initial Price. This Performance Has Prompted Hawk-Eyed Investors And YouTube Crypto Watchers To Spot A Hidden Gem In Avorak AI’s Investment Vehicle, With Others Fronting 100x Gains. The ICO Rewards Investors With Bonuses That Diminish Towards ICO Completion. However, Avorak AI, In Appreciation Of Investor Trust And Support, Is Offering A Final Round Of Mouth-Watering Bonuses As Per The Schedule Below:

$250 – $495 = 100% Bonus AVRK

$500 – $1,250 = 200% Bonus AVRK

$1,255 – $6,000 = 300% Bonus AVRK

$6005 – $10,250 = 400% Bonus AVRK

More Than $10,300 = 625% Bonus AVRK

Terms And Conditions

Bonus Can ONLY Be Applied To Purchases Made AFTER The Time Of This Message And Can Not Be Applied To Any Orders Made BEFORE This Post.

Bonus MUST Be Submitted Within 24hrs Of The Completed Purchase.

After Purchase, Please Note Your TXN Order Number And E-Mail Address Used For Your Avorak AI Account And Submit To Any Support Staff Via Website Live Chat, Telegram Or Discord.

Investors Meeting The Above Terms And Conditions Should Rush As It Lasts.

Wrap Up

The Outcome Of SEC Cases Will Have Far-Reaching Implications For The Cryptocurrency Industry, Setting Precedents For Future Legal Actions. Understanding The Nuances Of These Lawsuits Is Crucial, And Avorak AI Helps In Comprehending The Significance And Potential Consequences Of This Ongoing Legal Struggle Within The Crypto Space.

More On Avorak AI Here:

Website: Https://Avorak.Ai

Buy AVRK: Https://Invest.Avorak.Ai/Register

Leave a Reply