- Virtual lands are NFTs recorded on the blockchain and provide proof of ownership.

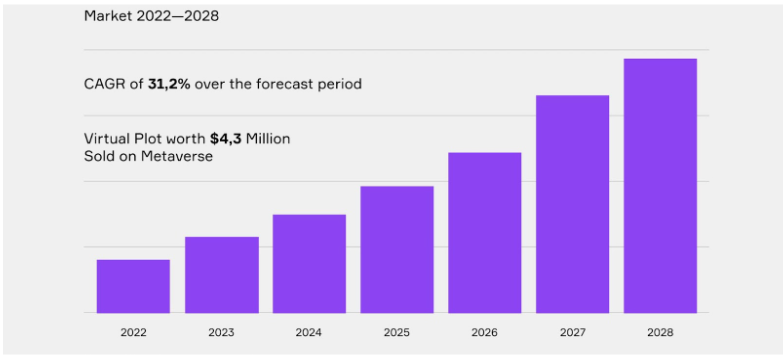

- Lately, companies are investing millions in this new, yet profitable sector.

Where owning a real estate property is still a dream for many, several companies and individuals are buying virtual land for thousands of dollars. This land does not exist physically, but only in a single, shared virtual space known as the metaverse.

The metaverse has been a hot topic in recent years but was limited to the research labs of tech companies. It became a household name when Facebook rebranded itself to Meta, and that’s when the term was googled more than ever before, entering the mainstream market.

A report by Bloomberg predicts that the Metaverse Market may reach a value of $936.6 Billion by 2030, and it’s not surprising to see the growth in this sector. Already, companies such as Meta, Microsoft, Nvidia, Qualcomm, and others have invested billions in this sector for R&D. Other companies are working on developing AR and VR headsets and gear, which will enable users to visit this world in their avatars. Within the Metaverse, the virtual estate business is gaining large attraction.

Real Dollars for Virtual Property

Metaverse Group, focused on giving quality virtual experiences to users, purchased a property for $2.43 Million on Decentraland. Republic Realm, a company dealing in virtual estate, bought a $1 Million plot on Decentraland. Axie Infinity, a popular play-to-earn game, sold the land for a whopping $2.3 Million. Additionally, a buyer purchased a virtual yacht for $650,000 on the Sandbox platform. These numbers show the rising interest and popularity of these virtual lands among investors and companies who believe in the dream of the metaverse.

Although the real estate business has been around for centuries, with people considering it a lucrative investment opportunity, virtual land offers several benefits over traditional physical properties. Several artists such as Ariana Grande, Justin Bieber, Marshmello, and others have hosted their virtual concerts. As more people hop in and participate in other similar opportunities, the value of these lands is sure to rise.

Physical properties offer slow liquidity, with people waiting for months to buy or sell a property. In contrast, virtual lands are similar to NFTs and can be traded on exchanges, providing instant liquidity. Real estate properties are expensive, and not everyone can afford them. However, the metaverse is in its development stage at present and offers land at costs affordable to individuals as well. The feature of buying them in fractions is also inviting for many people.

The design of houses, buildings, and other properties has to be properly planned and consulted by architects and interior designers. The expense also imposes limitations, and it may take months to build them. In contrast, virtual properties are nothing but codes, and users can design them without limitations in weeks. Early investors and owners can also rent their land to earn passive income.

Similar to real properties, the only thing that matters in deciding the value of your property is its location. A user spent nearly $450,000 in the Snoopverse to be the neighbor of Snoop Dogg, an American rapper. Similarly, as more people start living in the metaverse and engage in commerce and social gatherings, the location of their property from the city center will decide the value of their land.

Final Thoughts

These lands, like other NFTs, are purchased and traded through cryptocurrencies, which are subjected to high volatility, making them risky investments. Many virtual estate businesses even openly warn their customers that they may lose all of their money. However, people also believe in the shift of the internet from Web2 to Web3, where the Metaverse will play an important role.

Leave a Reply